Introduction

Bitcoin and Ethereum stand out above all others in the ever-evolving field of cryptocurrencies. These blockchain giants have revolutionized the digital economy and continue to be top choices for investors and developers alike. But in terms of profitability, which is superior, Ethereum or Bitcoin? In this in-depth blog, we’ll compare Bitcoin and Ethereum from every angle: price trends, technology, market behavior, mining profitability, use cases, and long-term potential. Whether you’re a seasoned investor or a curious beginner, this guide will help you make an informed decision in 2025.

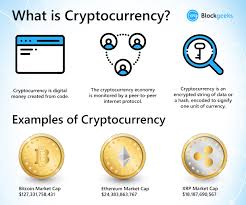

What is Bitcoin?

The first cryptocurrency in existence was Bitcoin (BTC), which was created in 2009 under the alias Satoshi Nakamoto. Due to its decentralized nature and limited supply (21 million coins), it is frequently referred to as “digital gold.” Key Features of Bitcoin:

Fixed supply

Highly secure network (Proof-of-Work)

Value storage Peer-to-peer international transactions High liquidity

How does Ethereum work? Ethereum (ETH) is a decentralized, open-source blockchain introduced in 2015 by Vitalik Buterin. Unlike Bitcoin, Ethereum is more than a digital currency — it’s a platform for smart contracts and decentralized applications (dApps).

Key Features of Ethereum:

Smart contracts and dApps

Implemented Proof-of-Stake (Ethereum 2.0) More flexible ecosystem

Continuous improvement and improvement Supports NFTs and DeFi platforms

Bitcoin vs Ethereum: Key Differences

Feature Bitcoin (BTC) Ethereum (ETH)

Launched 2009 2015

21 million Maximum Supply No fixed cap (although decreasing issuance) Consensus Mechanism Proof-of-Work Proof-of-Stake (since The Merge)

Purpose Digital gold, payments Smart contracts, DeFi, NFTs

Block Time ~10 minutes ~12 seconds

Development Speed Slow Fast and community-driven

Ethereum vs. Bitcoin: A Comparison of Profitability Now, let’s dive deeper into the core question: Which is more profitable — Bitcoin or Ethereum?

1. Price Growth History

Bitcoin:

2015 Price: ~$250

2021 ATH: ~$69,000

2025 Range (as of April): $65,000–$72,000

Average annual growth: ~200% (historic)

Ethereum:

2015 Price: ~$0.75

2021 ATH: ~$4,800

2025 Range (as of April): $3,500–$4,200

Average annual growth: ~300% (historic)

➡ Verdict: Ethereum has shown faster growth percentage-wise, but Bitcoin holds more stable value over time.

2. ROI and transaction fees Bitcoin:

Average transaction fees: Higher during peak congestion

ROI is more stable, but the profit curve is slower

Ethereum:

Gas fees used to be high, but ETH 2.0 has improved scalability

Staking rewards add an extra income layer

Conclusion: Ethereum’s vibrant ecosystem (NFTs, DeFi) may offer more opportunities for short-term ROI. 3. Mining vs Staking Profitability

Bitcoin Mining:

expensive ASIC miners are required. High energy cost

Halving events reduce rewards

Ethereum Staking:

Staking ETH can give you a steady income. Low energy use (eco-friendly)

Less upfront hardware cost

➡ Verdict: Ethereum staking is more accessible and energy-efficient, making it profitable for more users.

4. Volatility and Risk

Bitcoin is considered less volatile due to its strong market dominance.

Ethereum’s swings can be more extreme, particularly during NFT or DeFi booms. ➡ Verdict: Bitcoin is better for low-risk, long-term investors, while Ethereum is suitable for high-risk, high-reward strategies.

Use Cases and Potential for the Future Use Cases for Bitcoin: Hedge against inflation

Cross-border transfers and payments Store of wealth for institutions

The Use Cases of Ethereum: “Decentralized finance” or “DeFi” NFT Marketplaces (OpenSea, Rarible)

Web3 and dApp creation Tokenized assets and DAOs Conclusion: Ethereum has a wider range of applications, which may result in increased profitability in the future. Predictions by Experts for the Years After 2025 Bitcoin Forecast:

Could reach $100,000+ if institutional adoption grows

Considered a safe haven asset similar to gold Forecast for Ethereum: Could surpass $8,000 with expanding DeFi and NFT activity

ETH’s deflationary model could boost price post-ETH 2.0

Which Should You Invest In?

Invest in Bitcoin if:

You want long-term stability

You want to lower the risk. You want a proven asset with institutional backing

Invest in Ethereum if:

You’re interested in new technology. You should be exposed to Web3, NFTs, and DeFi. You’re comfortable with higher volatility

Tips for Maximizing Profitability

Diversify: Hold both BTC and ETH to hedge risk.

Keep up to date by following developments in the blockchain and market news. Use Staking and Yield Farming (for ETH): Generate passive income.

Choose the Right Time: Buy during dips, not hype.

Use Secure Wallets: Avoid scams and keep your assets safe.

Conclusion: Which is more profitable in 2025—Bitcoin or Ethereum? There’s no one-size-fits-all answer. Bitcoin offers stability and proven value, while Ethereum delivers innovation and potential for higher returns — but with more risk.

A balanced portfolio with both assets can provide the best of both worlds.

Bitcoin vs Ethereum

Profitability of Ethereum versus Bitcoin Which crypto is more profitable

Bitcoin investment 2025

Ethereum staking 2025

Bitcoin versus Ethereum 2.0 Crypto investment guide

Best cryptocurrency to invest in 2025

Potential for profit on Ethereum Bitcoin long-term investment

Suggested Tags

#Bitcoin, #Ethereum, #CryptoInvestment, #EthereumStaking, #Bitcoin2025, #Ethereum2.0, #DeFi, #Blockchain, #CryptoProfits, and #InvestingTips are some of the topics covered. Let me know if you want this turned into a downloadable article, formatted for WordPress, or turned into a social media thread!

Introduction

Bitcoin and Ethereum stand out above all others in the ever-evolving field of cryptocurrencies. These blockchain giants have revolutionized the digital economy and continue to be top choices for investors and developers alike. But in terms of profitability, which is superior, Ethereum or Bitcoin? In this in-depth blog, we’ll compare Bitcoin and Ethereum from every angle: price trends, technology, market behavior, mining profitability, use cases, and long-term potential. Whether you’re a seasoned investor or a curious beginner, this guide will help you make an informed decision in 2025.

What is Bitcoin?

The first cryptocurrency in existence was Bitcoin (BTC), which was created in 2009 under the alias Satoshi Nakamoto. Due to its decentralized nature and limited supply (21 million coins), it is frequently referred to as “digital gold.” Key Features of Bitcoin:

Fixed supply

Highly secure network (Proof-of-Work)

Value storage Peer-to-peer international transactions High liquidity

How does Ethereum work? Ethereum (ETH) is a decentralized, open-source blockchain introduced in 2015 by Vitalik Buterin. Unlike Bitcoin, Ethereum is more than a digital currency — it’s a platform for smart contracts and decentralized applications (dApps).

Key Features of Ethereum:

Smart contracts and dApps

Implemented Proof-of-Stake (Ethereum 2.0) More flexible ecosystem

Continuous improvement and improvement Supports NFTs and DeFi platforms

Bitcoin vs Ethereum: Key Differences

Feature Bitcoin (BTC) Ethereum (ETH)

Launched 2009 2015

21 million Maximum Supply No fixed cap (although decreasing issuance) Consensus Mechanism Proof-of-Work Proof-of-Stake (since The Merge)

Purpose Digital gold, payments Smart contracts, DeFi, NFTs

Block Time ~10 minutes ~12 seconds

Development Speed Slow Fast and community-driven

Ethereum vs. Bitcoin: A Comparison of Profitability Now, let’s dive deeper into the core question: Which is more profitable — Bitcoin or Ethereum?

1. Price Growth History

Bitcoin:

2015 Price: ~$250

2021 ATH: ~$69,000

2025 Range (as of April): $65,000–$72,000

Average annual growth: ~200% (historic)

Ethereum:

2015 Price: ~$0.75

2021 ATH: ~$4,800

2025 Range (as of April): $3,500–$4,200

Average annual growth: ~300% (historic)

➡ Verdict: Ethereum has shown faster growth percentage-wise, but Bitcoin holds more stable value over time.

2. ROI and transaction fees Bitcoin:

Average transaction fees: Higher during peak congestion

ROI is more stable, but the profit curve is slower

Ethereum:

Gas fees used to be high, but ETH 2.0 has improved scalability

Staking rewards add an extra income layer

Conclusion: Ethereum’s vibrant ecosystem (NFTs, DeFi) may offer more opportunities for short-term ROI. 3. Mining vs Staking Profitability

Bitcoin Mining:

expensive ASIC miners are required. High energy cost

Halving events reduce rewards

Ethereum Staking:

Staking ETH can give you a steady income. Low energy use (eco-friendly)

Less upfront hardware cost

➡ Verdict: Ethereum staking is more accessible and energy-efficient, making it profitable for more users.

4. Volatility and Risk

Bitcoin is considered less volatile due to its strong market dominance.

Ethereum’s swings can be more extreme, particularly during NFT or DeFi booms. ➡ Verdict: Bitcoin is better for low-risk, long-term investors, while Ethereum is suitable for high-risk, high-reward strategies.

Use Cases and Potential for the Future Use Cases for Bitcoin: Hedge against inflation

Cross-border transfers and payments Store of wealth for institutions

The Use Cases of Ethereum: “Decentralized finance” or “DeFi” NFT Marketplaces (OpenSea, Rarible)

Web3 and dApp creation Tokenized assets and DAOs Conclusion: Ethereum has a wider range of applications, which may result in increased profitability in the future. Predictions by Experts for the Years After 2025 Bitcoin Forecast:

Could reach $100,000+ if institutional adoption grows

Considered a safe haven asset similar to gold Forecast for Ethereum: Could surpass $8,000 with expanding DeFi and NFT activity

ETH’s deflationary model could boost price post-ETH 2.0

Which Should You Invest In?

Invest in Bitcoin if:

You want long-term stability

You want to lower the risk. You want a proven asset with institutional backing

Invest in Ethereum if:

You’re interested in new technology. You should be exposed to Web3, NFTs, and DeFi. You’re comfortable with higher volatility

Tips for Maximizing Profitability

Diversify: Hold both BTC and ETH to hedge risk.

Keep up to date by following developments in the blockchain and market news. Use Staking and Yield Farming (for ETH): Generate passive income.

Choose the Right Time: Buy during dips, not hype.

Use Secure Wallets: Avoid scams and keep your assets safe.

Conclusion: Which is more profitable in 2025—Bitcoin or Ethereum? There’s no one-size-fits-all answer. Bitcoin offers stability and proven value, while Ethereum delivers innovation and potential for higher returns — but with more risk.

A balanced portfolio with both assets can provide the best of both worlds.

SEO Keywords (Use Throughout the Blog)

Bitcoin vs Ethereum

Profitability of Ethereum versus Bitcoin Which crypto is more profitable

Bitcoin investment 2025

Ethereum staking 2025

Bitcoin versus Ethereum 2.0 Crypto investment guide

Best cryptocurrency to invest in 2025

Potential for profit on Ethereum Bitcoin long-term investment

Suggested Tags

#Bitcoin, #Ethereum, #CryptoInvestment, #EthereumStaking, #Bitcoin2025, #Ethereum2.0, #DeFi, #Blockchain, #CryptoProfits, and #InvestingTips are some of the topics covered. Let me know if you want this turned into a downloadable article, formatted for WordPress, or turned into a social media thread!